Our Solutions

Introducing “OfficeTime” - your new comprehensive digital platform for HR management, adapted for office and remote working.

"CautionFirst" to your e-learning platform on Information and Cybersecurity defense.

KYC

Access our comprehensive data sets, which have been compiled from over 20,000 government sources, allowing you to identify politically exposed persons and their close associates. Screen against thousands of government regulatory and law enforcement watchlists, and over 100 International and National Sanctions lists that are updated daily.

- Reliable Data Sources

- Batch Screening

- Minimise False Matches

- Updated Daily

- Global Coverage

- API Integration

- Due Diligence Workflows

Digital ID

eIDAS defined the digital identification & the trust services for the electronic transactions (electronic signature, digital identity…) since 2014. The digital identify allows citizens access to value added services such as access to Open Banking APIs or Legal Archiving.

- Single Electronic Identification (eID)

- Interoperability of eID

- Secure Authentication

- EIDAS Compliance

- Integration of Digital Wallet

Adverse Media Check

AI-driven analysis of negative news associated with money laundering and financial crime enhances due diligence efforts in line with the latest AML compliance requirements.

- Reliable Data Sources

- Up-To-Date Information

- Batch Screening

- Global Coverage

- API Integration

Central Bank Digital Currency (CBDC)

Central Bank Digital Currency (CBDC) is a new form of money that exists only in digital form. Instead of printing money, the central bank issues widely accessible digital coins so that digital transactions and transfers become simple.

- One-to-One Exchange Rate

- Digital Wallet

- Built-In Smart Contracts

- Increased Speed of Transactions

- Cost Reduction from Reduced Infrastructure

Governance, risk, and compliance (GRC)

Quickly assess and act on the biggest risks facing your organization with a connected view of risks and controls using our Enterprise Risk Management solution. Easily identify, monitor, and manage risks across your organization and communicate a holistic view of risks.

- Enterprise Risk Management Solution.

- Internal Audit Solution.

- Quick assessment of biggest risks.

- Easily identify and management of risks.

- Holistic view of risks.

Datamart

Prudential and operational supervision is necessary in a framework to reduce risks to the soundness of the banking system and enhance banks' role as active players in the development of the economy. Our reporting solutions helps to validate the available data at a centralized location for potential opportunities, threats, strengths, weakness.

- Adhoc Reports

- Projections

- Data Visualisation

- Collaboration

- Manual Data Adjustments

Want to know more about our solutions?

What Makes Us Unique?

User-friendly Platform

We delivers an enhanced user experience by consolidating all your screening needs in a modern, interactive dashboard.

Proprietary Data

Our global database of sanctioned individuals is updated on a daily basis to keep you up-to-date with the most recent PEP/RCA profiles and sanction lists.

Built for Developers

Reduce the time taken for integration, from months to days, with our developer-friendly Restful API and its comprehensive documentation.

Our Targeted Market

Regulated Entities

Regulators

DNFBP

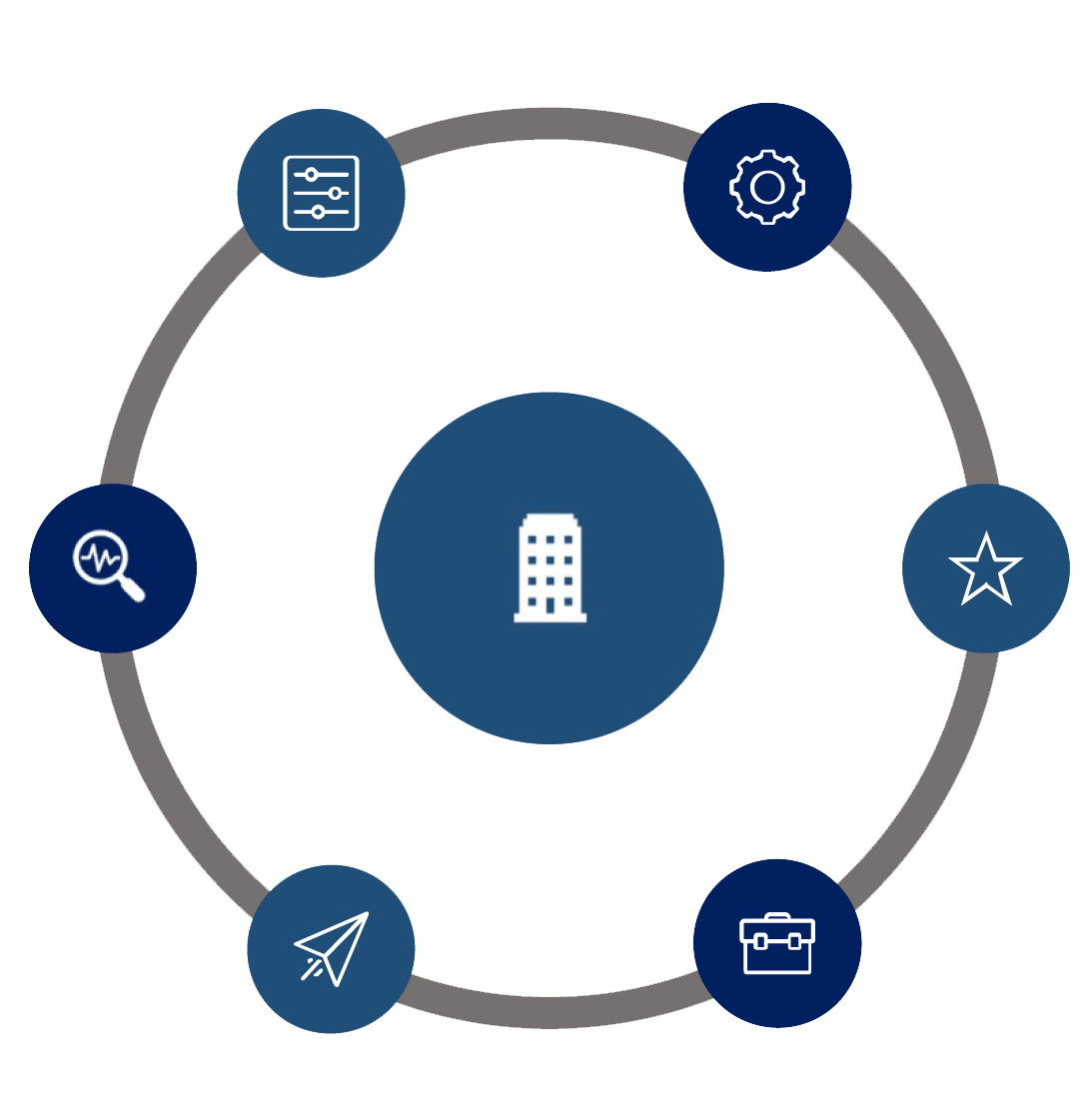

Single Platform, Multiple Data Sources

Each data source includes:

Our Services & Expertise

CONSULTING

TECHNOLOGY

IMPLEMENTATION

Our presence

Challenges faced by financial institutions

TECHNOLOGY

Adjusting to technological developments Reaping the rewards of technological investments The emphasis is now on effectiveness

RESEARCH

Endless research on transactional behaviour Emerging risk identification & updating of the EWRA

REGULATORY INSPECTIONS

Heavy pressure from the regulators Regulators themselves are under pressure with respect to FATF evaluations

TECHNOLOGY

Adjusting to technological developments Reaping the rewards of technological investments The emphasis is now on effectiveness

RESEARCH

Endless research on transactional behaviour Emerging risk identification & updating of the EWRA

REGULATORY INSPECTIONS

Heavy pressure from the regulators Regulators themselves are under pressure with respect to FATF evaluations

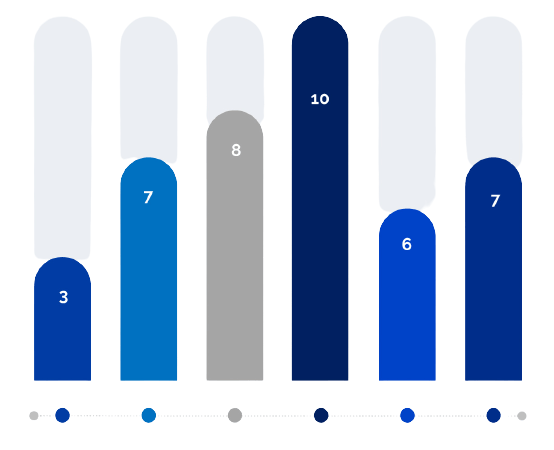

FALSE POSITIVES

Requires a fundamental understanding of risk typologies Creation of new risk profiles

COMPLACENCY

Dangers of Complacency

Slow-paced approach to calibration

Willingness to identify & program new components

RESULTS

Addressing the deficiencies identified by Internal Audit teams and the Independent AML/CFT Audit function

Substantiating our input

The Enterprise-Wide RA

Scoping of Inherent Risks

Residual Risk

Effectiveness of monitoring Allocation of responsibilities Sample testin

Sector-specific risks

Applying expertise to address sector-specific risks

Effectiveness

Risk Mitigating Controls Sample Testing & Audit reports

Mutual Evaluation Reports

Country-specific information and issues highlighted by FSRB assessors

Upcoming Assessments

Institutional readiness for

regulatory inspections

Regulatory Notices in the sector

Supervisory Guidance

Typologies

EWRA

FATF reports

NRA

Our services & expertise

Confidentiality

• Essential pre-requisite

• Assistance to address regulatory issues

• Relevance of existing parameters to the client pool

Fundamentals

• Policies & Procedures

• Defined Risk Appetite

• Logging and recording of changes applied

• Case management attitudes & effectiveness

• Knowledge of risk typologies

• Understanding of emerging risks

Confidentiality

• Essential pre-requisite

• Assistance to address regulatory issues

• Relevance of existing parameters to the client pool

Fundamentals

• Policies & Procedures

• Defined Risk Appetite

• Logging and recording of changes applied

• Case management attitudes & effectiveness

• Knowledge of risk typologies

• Understanding of emerging risks

Onsite deployment

• Calibration of thresholds

• Patterns detection

• Selection of components

• Alert generation & triggers

• Reduce false positives

Onsite deployment

• Calibration of thresholds

• Patterns detection

• Selection of components

• Alert generation & triggers

• Reduce false positives

Understanding our clients’ issues

• Client Instructions

• Terms of Reference defined

• Letters of Engagement

• Implementation excellence

• Progress reporting

Understanding our clients’ issues

• Client Instructions

• Terms of Reference defined

• Letters of Engagement

• Implementation excellence

• Progress reporting

We can be of help

Client retention through onsite dedicated support

Addressing the presence of competitors in the region

Delivering value to financial institutions

Your clients benefit from the presence of trained Regulators